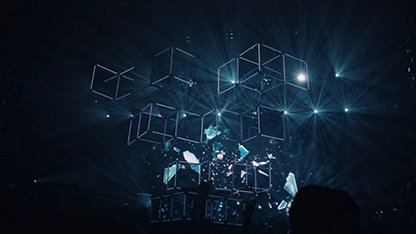

Making order out of disruption.

Digitalisation is transforming our interactions and transactions, habits and habitats. In this new age of possibility, we are both more connected and more divided than ever before. What does the fourth industrial age mean for the built and natural environment?

A more equitable future is within reach. First, we must harness the enormous potential of the 21st century’s people, places and spaces. #WBEF

Latest Insights

Applied filters:

Clear all filters

Professional conduct and the responsible use of AI

04 Mar 2025

The awareness and use of AI across the land and property life cycle has steadily grown in recent years, bringing both advantages and risks to professionals and their clients.

Wicked problems in construction: managing the risks posed by using AI

28 Feb 2025

What risks are associated with using AI in construction? In the final of this three-part series, four industry experts explain the steps industry can take to manage AI-related risks while capitalising on its benefits.

Wicked problems in construction: the main problems that AI can help solve

21 Feb 2025

How will artificial intelligence improve construction productivity and health and safety while also reducing its environmental impacts? In the second if this three-part series, four industry experts discuss the potential to tackle these ‘wicked’ problems using AI.

Can increased data transparency improve house affordability in Europe?

19 Feb 2025

Can improved access to more accurate data help to counteract property price inflation in Europe? Nils Henning, CEO and Co-founder of CASAFARI, examines how data availability impacts housing markets in the region.

Wicked problems in construction: how the intelligent use of AI can help

12 Feb 2025

How can artificial intelligence benefit the construction industry? In first of this three-part series, four industry experts examine the considerations necessary for construction to capitalise on the benefits of AI.

Data centres: can innovations reduce the environmental impacts of this asset class?

07 Feb 2025

As the demand for data centres grows, how can their environmental impacts be mitigated? In the second of this two-part series, Tarrant Parsons, RICS head of market analytics, examines the innovations that could help reduce the carbon and water intensity of this real estate sector.

Digitalisation in the Indian construction sector: A comparative study from design to handover

27 Aug 2024

India could become the third-largest economy in the next five years, according to the World Economic Forum. Construction is a significant contributor to the country’s gross value added (GVA), however, labour productivity in India's construction sector is lagging.

How can the construction workforce benefit from Industry 4.0?

22 Feb 2024

The fourth industrial revolution - or Industry 4.0 - is characterised by an increased connection between automation, production and data exchange. A recent WBEF webinar discussed the implications for companies and the construction workforce alike.

Unleashing AI in the built environment: A path to sustainable decarbonisation

25 Jan 2024

Confronted with the urgent challenge of climate change, the call for innovative solutions has never been more acute. Here, artificial intelligence (AI) emerges as a transformative force, poised to reshape our approach to building and urban development.

Showing 1-10 of 121 items