How could abolishing the dollar-peg affect Hong Kong’s future as a financial hub? With quarantine and COVID-19 testing now lifted, Hong Kong stands at the beginning of a new chapter. Donglai Luo, RICS Senior Economist, analyses on-going challenges with international trade and the exchange rate regime.

Ongoing challenges for Hong Kong in international trade

As the traditional trade hub in the region, the trading and logistics industry has been essential for Hong Kong’s economy. Identified by the government as one of the four pillars of the economy, the sector accounted for 23.7% of the value added in GDP in 2021. Trade value as percent of GDP in Hong Kong was 384% in 2022, ranking second globally (after Luxembourg), according to the World Bank. Hong Kong’s top four trading partners are mainland China, ASEAN, EU and the US.. Notably, Hong Kong acts as the gateway for mainland China, with re-exports from China accounting for 57% of the total re-export value in 2022.

However, Oxford Economics predicted a negative growth rate in net exports in 2023, at the lowest since 2019. The decrease in net exports does not bode well in the broader context of intense competition Hong Kong faces in global trade. As one of the most important trade hubs in the region, goods are often shipped to Hong Kong before being re-exported to their final destinations. This is particularly true during years of booming manufacturing business in China.

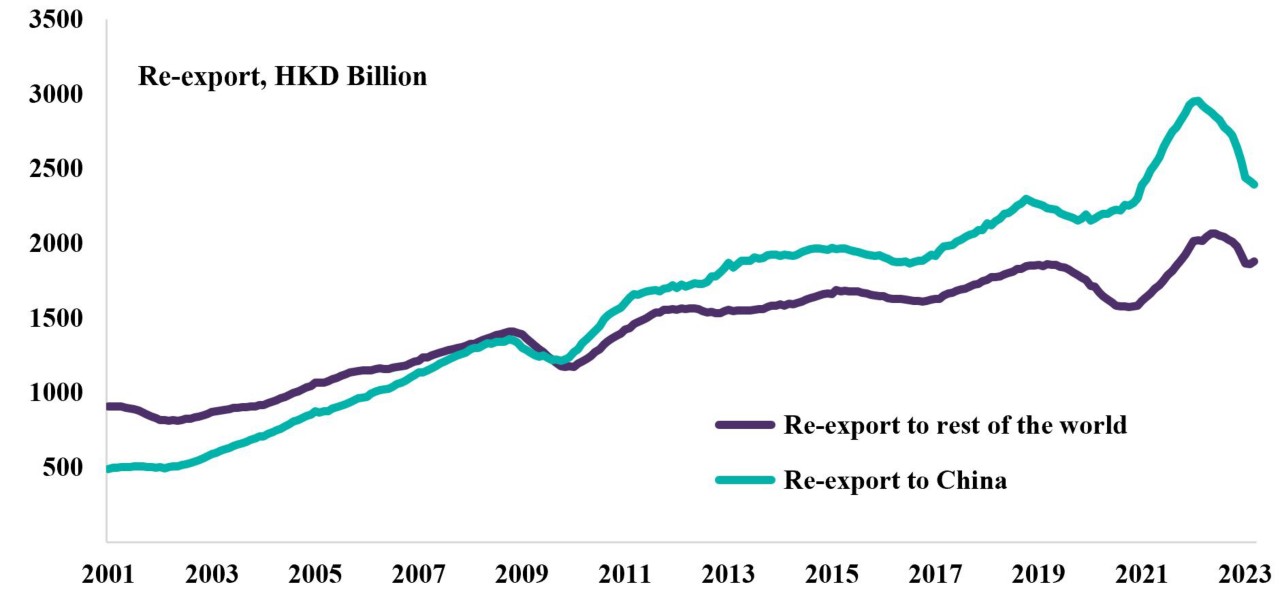

Figure 1: Re-export trends in Hong Kong (source: Macrobond)

Figure 1 depicts the values of re-exports in Hong Kong across the past two decades. Notably, during 2022, the re-export values to China and other countries saw significant drops after they peaked in 2021. Over a longer timeframe, a visible shift occurred in 2009 when the value of re-exports to China surpassed the value of re-exports to the rest of the world. Since then, the gap has continued to widen. Strong competition could be the driving force behind these dynamics.

According to the rankings of port cities by the World Shipping Council, Shanghai and Singapore rank as the top two ports in terms of trade volume. In contrast, Hong Kong only ranks eighth in 2021 (it was fifth in 2017). In fact, five of the top seven ports are in mainland China. As a result, trade flows from Hong Kong to other countries have been diverted. Furthermore, the significance of re-exports to China has steadily grown since 2008, indicating a shift in Hong Kong’s role from being a gateway for goods leaving China to a gateway for goods entering China.

In summary, Hong Kong is currently experiencing ongoing challenges in the international trade sector. These challenges have sparked discussions about the need for Hong Kong to reposition itself and make changes to its policies.

Should the Hong Kong-US dollar peg be abolished?

Hong Kong ranks fourth in the latest Global Financial Centres Index, slipping only one place from the previous ranking. Despite this, there are discussions about the loss of its position as the top financial centre in Asia, to Singapore. One of the hotly debated topics is the foreign exchange rate regime in Hong Kong as it is one of the most significant differences between the financial systems in the two markets. The Linked Exchange Rate System (LERS) is responsible for keeping the peg of the Hong Kong dollar with the US dollar. It has historically contributed to the stability of the financial system and has also played a role in attracting foreign investment and facilitating international trade.

The key argument for abolishing the dollar peg is to adapt to the increased economic dependency on China (as implied by the relative importance of re-exports to China mentioned in the previous section). The direct consequence of the dollar peg is the loss of flexibility of the monetary policy, which makes Hong Kong more vulnerable to the economic cycles in the US.

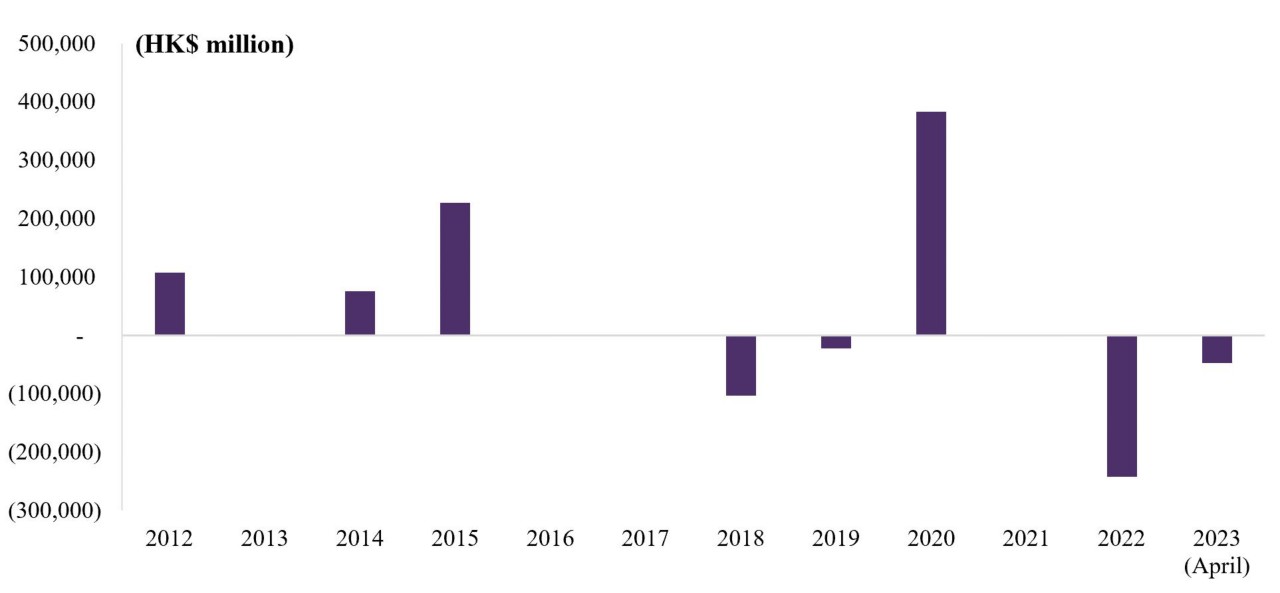

The increasing economic integration with China may create a significant mismatch in monetary policy. For example, as Hong Kong just stepped out of its COVID-19 restrictions, dovish monetary policy would support its economic recovery. However, Hong Kong is suffering from high interest rates imported from the US, which directly suppresses its asset valuations and upsets property and stock markets. Moreover, when the dollar market has higher/lower interest rates, interventions must be carried out by the Hong Kong Monetary Authority (HKMA) (as seen in 2020 and 2022 in Figure 2).

“The increasing economic integration with China may create a significant mismatch in monetary policy.”

These interventions will either cost Hong Kong its foreign reserves to buy more local currency or increase the risk of inflation by selling more local currency to the market. Bill Ackman, the well-known investor and billionaire, has supported the move to short the Hong Kong dollar, arguing that the system is no longer relevant. This reflects the changing perception of Hong Kong as being increasingly seen as part of the greater China market, rather than as a separate entity. In this view, it is no longer seen as beneficial to maintain a rigid exchange rate that restricts monetary policy. In addition, the rigidity also exposes the system to geopolitical risks. As the dollar peg is backed by the liquid US dollar assets held by HKMA, if for some reason, HKMA would lose the access to US dollar clearing, the peg would dissolve immediately. In this sense, a bet against the dollar peg would make more sense in the case of more turmoil in the US-Sino relation.

Figure 2: HKMA Market Intervention showing the dollar peg is under pressure (source: HKMA, +/-: buy/sell HKD)

Benefits to keeping the dollar peg

However, there are some advantages to maintaining the current regime. Despite past challenges, the LERS could still be considered an essential component of Hong Kong's position as an international financial centre.

Notwithstanding the increasing tensions between China and the US, the LERS is expected to continue serving as a bridge connecting China and the rest of the world. Anecdotal evidence highlighted in the Financial Times in 2022 shows three out of ten companies that have the most employees in Hong Kong are from mainland China, compared to none in 2012. Investment banks, providing financial services to mainland corporations and investors interested in investing in China make up a significant portion of these companies.

Political factors also play a role, as neither the China central government nor the Hong Kong Monetary Authority are willing to risk its stability. Additionally, as the largest offshore RMB (Renminbi) market, Hong Kong plays a pivotal role in the internationalisation of the Chinese currency and the dollar peg can be helpful.

“As the largest offshore RMB (Renminbi) market, Hong Kong plays a pivotal role in the internationalisation of the Chinese currency and the dollar peg can be helpful.”

Recent developments from Hong Kong Exchanges and Clearing Market (HKEX) would support our argument. In December 2022, to further support the RMB development in the Hong Kong securities market, HKEX introduced HKD-RMB dual counter model and dual counter market making programme in the Hong Kong securities market, which connects the Chinese Yuan directly to equity trading in Hong Kong without sacrificing the market stability.

Another similar move comes from the Swap Connect Scheme in the bond market. The scheme will provide trading and clearing services for Hong Kong and international investors to access Mainland China’s financial derivatives market, and for investors in Mainland China to access Hong Kong’s financial derivatives market. In its initial stage, Swap Connect will allow Hong Kong and international investors to participate in Mainland China’s interbank interest rate swap market, without changing their existing trading and settlement practices. These schemes connecting China and Hong Kong’s financial markets aim to combine the mainland market with Hong Kong’s highly recognised financial industry to attract global investors to the region.

Conclusions

The debate around LERS is a snapshot of Hong Kong’s challenges as a financial hub where political consideration intertwines with economic benefits. Abolishing the dollar peg could significantly weaken Hong Kong’s recognition and hinder the efforts capitalise on it. Therefore, we conclude that Hong Kong’s dollar peg will still serve both the local market and mainland China and continue to help Hong Kong to maintain its leading position as financial centre providing access to China market.

Without question, the macro-economic climate for Hong Kong has undergone significant shifts regarding international trade and finance. It is important to review the strategies and policies that the administration could employ to sustain the city's progress.

In the next article in this series article, we address one of the prevailing themes in the upcoming year: the Greater Bay Area Development Plan.