My firm provides regular revaluations of a ground rent portfolio to the freeholder, to include vacant possession valuations. The long leaseholder is seeking finance secured against the properties and we have been approached by the bank to provide valuations for loan security purposes. Are we able to accept the instruction from the bank?

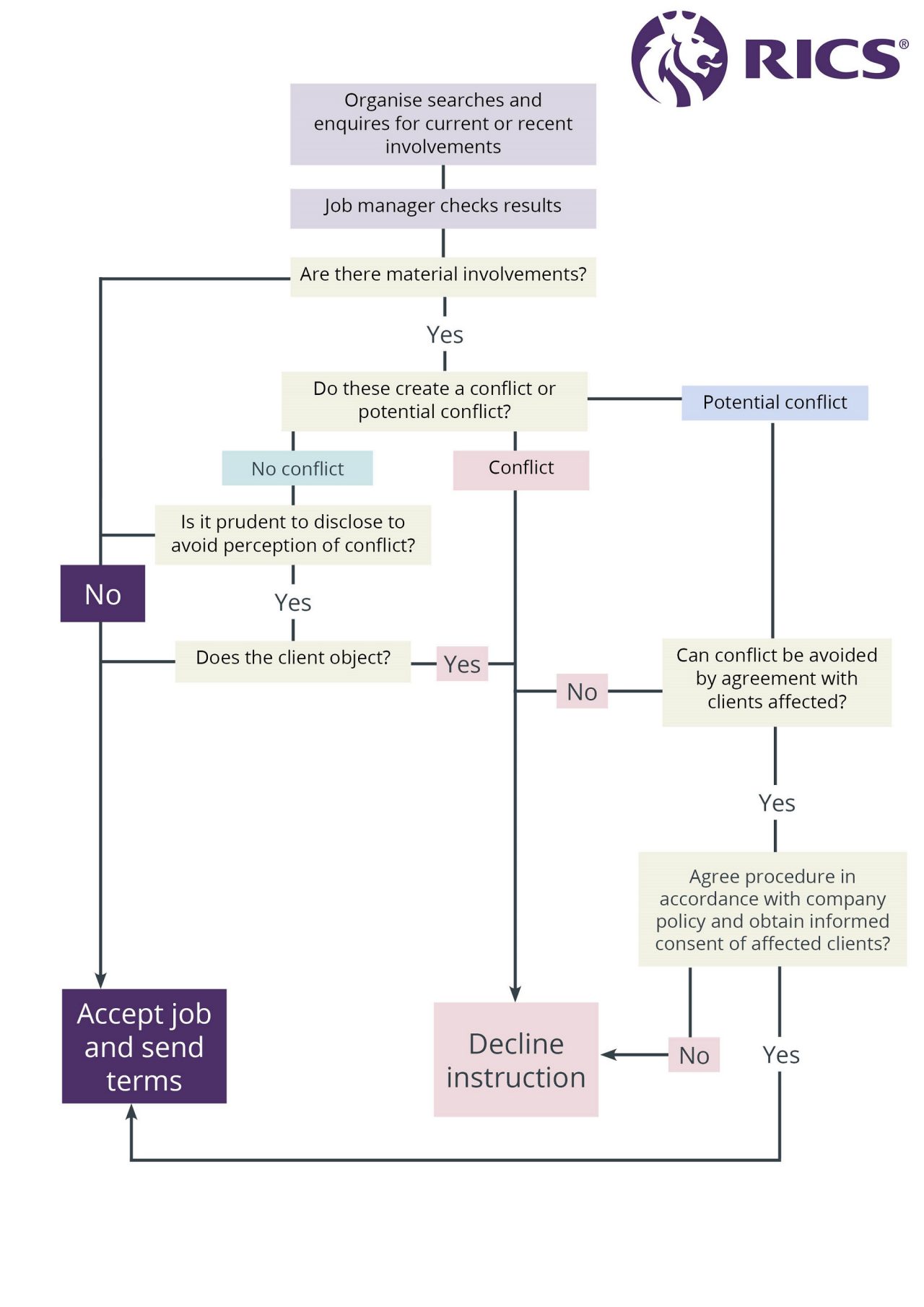

If you have an ongoing contract with the freeholder, this instruction would involve acting for two different clients on the same property at the same time. That would constitute a party conflict, which would require the informed consent of all parties, before the new instruction could be accepted.

If you do not have an ongoing contract with the freeholder, this request to value a property or asset previously valued for another client of the firm raises a potential threat to independence and objectivity. Your primary duty is to your existing client, the freeholder. However, under some circumstances, the fact that you have good knowledge of the property and can therefore do the work more quickly than a rival firm could be advantageous to both your existing client (the freeholder), the lender and therefore the leaseholder. Bear in mind that even if you consider there is no conflict, under Red Book Global Standards VPGA 2 you would also need to disclose your other involvement with the property to the prospective lender.

It is possible that there could be confidential information that you are party to because of your firm’s relationship with the freeholder. You would need to consider whether you could fulfil your duty to the lender without disclosing this information. If the information is critical to the value then a conflict cannot be avoided and the instruction from the lender should be declined.

You should think carefully about whether the interest you are valuing for the lender would affect the interests of the existing freeholder client, or vice versa, because this might threaten your objectivity or appear to do so. A concern that the new valuation might adversely affect an existing client could be a party conflict. For example, if the ground rent is aligned to the market value of the long leasehold interest, this could give rise to a reasonable concern from the lender client that your existing relationship could have affected your assessment of market value.

If based on the circumstances of this case you consider that there is a potential conflict of interest you must be satisfied before proceeding that:

a) it is in the interests of both parties that you undertake the work

b) that any risk of a conflict arising can be avoided by putting in place an effective information barrier and

c) that you can seek informed consent to act without disclosing any confidential information.

If you are satisfied that these conditions are met, you should first seek the consent of your existing client, the freeholder, and then disclose your involvement to the lender as per VPGA 2. If an information barrier is necessary, this will also need to be agreed by both parties. Unless these conditions are met the instruction from the lender should be declined.