Do increasing vacancy rates signal a permanent structural shift in office tenant demand? In the second of this three-part series, Tarrant Parsons, RICS Senior Economist, looks at the data indicating longer term changes in tenant demand.

City and regional office vacancy rates

Examining trends across the office sector shows there has been some noteworthy increases in vacancy rates following the pandemic. Costar data demonstrates that, having hit a low of 4.6% in Q1 2020, the national office vacancy rate throughout the UK now stands at 7.6% (the highest in nine years). That equates to over 100million sq ft of empty space. Moreover, their forecasts point to the rate of vacant office space continuing to rise through to 2025, by which stage it is expected to exceed 9%. In the United States, Costar estimates that the current rate of office vacancies is higher still at close to 13%, with projections pointing to this surpassing 16% in two years’ time.

Office utilisation, i.e. the proportion of available desks that are actually used during the working week, can provide a deeper level of insight. Research from Savills calculates that average office utilisation (or ‘occupancy’ as they refer to it) across Europe stood at 55% as of March 2023. This is down from an estimated rate of 70% at the start of 2020, albeit up from around 43% a year earlier.

As Savills data is based on figures from their own European Property Management network (located in central business districts across selected European cities), this estimate may not be reflective of utilisation trends in smaller regional offices. For instance, research conducted by Remit Consulting shows that in the week ending 21 April 2023 the national average office occupancy rate in the UK was at roughly 36%. This is noticeably lower than the Savills indicator on London West End and City occupancy, which came in with an estimate at close to 50%.

“…the national office vacancy rate throughout the UK now stands at 7.6% (the highest in nine years). That equates to over 100million sq ft of empty space.”

A crucial factor likely contributing to this discrepancy is that prime, high spec and modern space is being preferred over older lower grade stock (with Savills data likely reflecting more of the former). In support of this notion, Costar figures point to net absorption across office buildings classed as 'Five Star’ (the highest quality based on their own rating system) remaining positive even throughout the pandemic. Conversely, all demand losses were concentrated across buildings rated ‘Four Star’ or below.

Net absorption considers tenants leaving as well new tenants occupying space. For buildings that were delivered from 2010 onwards, CoStar data shows net absorption has been positive to the tune of 10million sq ft in London. In comparison, this was just over 15million sq ft throughout the UK regions.

Less is more

By way of contrast, CoStar data also shows deeply negative net absorption figures since the pandemic, which can be seen across buildings delivered earlier than 2010. In London, this decline stands at around 16million sq ft, while across the regions the figure is even larger at close to 30milliion sq ft. In both instances, office buildings constructed pre-1980 have suffered the steepest drop in net absorption compared to all other categories.

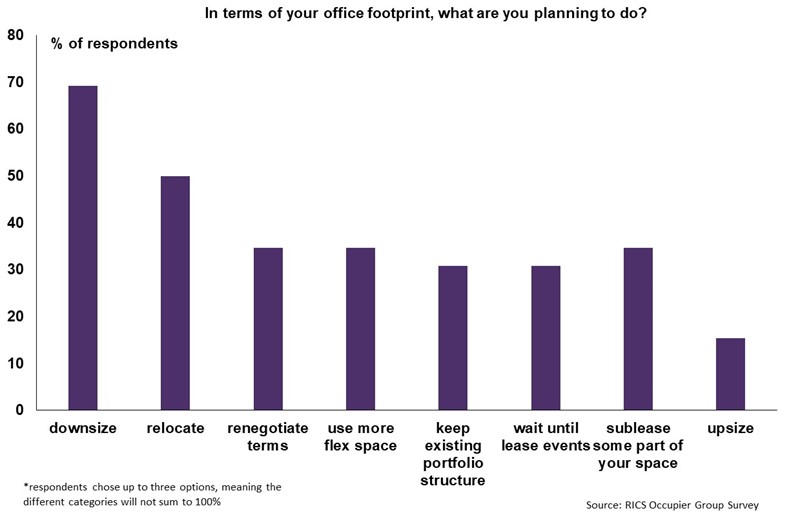

Firms downsizing office footprints is another identifiable post-pandemic trend. A survey conducted by Bloomberg Intelligence revealed that a quarter of the companies included in the sample have reduced the size of their office holdings since the start of the pandemic. Going forward, it seems this pattern has further to run based on the feedback to the inaugural 2023 RICS occupier survey (Figure 1). The results show nearly 70% of respondents have plans to downsize their office footprint. Consequently, it looks as if quality of space is increasingly taking precedence over quantity in the aftermath of the pandemic.

Figure 1: Occupier plans for their office footprint

A structural shift in office tenant demand

Firms are now looking for the type of space that can fulfil several criteria, including providing an appealing workplace with great amenities that will entice staff into the office and spaces that also welcome clients to help build and foster relationships. Equally as important is a building that meets growing ESG requirements. This structural shift in office tenant demand is therefore causing a polarisation between best-in-class office space and the rest.

This point is further supported in the recent RICS Global Commercial Property Monitor (GCPM) data on rental growth expectations. Despite challenging macro conditions, prime office rental growth projections for the year ahead are marginally positive at +0.4% (on a global weighted average). In contrast, secondary office rents are seen falling by 4% on the same basis. Prior to 2020, global prime office rental growth projections on average sat 2% above those for secondary. However, over the past year, the gap has widened to over 4%.

Headline measures of rents will exclude incentive packages, which have been rising sharply ever since the pandemic. This is again evidenced by the RICS GCPM data, which shows, at a global level, an average net balance of +41% of survey participants reporting an increase in inducements across the office sector in each quarter since Q2 2020.

Crucially, this trend has shown no sign of abating in recent quarters, with anecdotal comments frequently pointing to heightened difficulties in secondary office markets while prime offices are proving much more resilient. For example, Daniel Smethurst MRICS commented in the RICS UK Commercial Property Monitor that ‘prime office rents are holding firm providing accommodation is of a good standard and ticks occupier expectations. There is no evidence that incentives have moved out on prime stock’.

What prospects for lower quality office stock?

It appears the office sector is increasingly becoming a two-tier market, with secondary space often being overlooked in favour of offices that include the best amenities and green credentials. While this suggests that the office sector will continue to provide opportunities for investors at the top end of the quality spectrum, what does it mean for the longer-term prospects for older, lower quality office stock? The final part of this series will examine whether increasing energy efficiency standards will eclipse flexible working as the primary driver of change in office demand.