This research enhances understanding of the infrastructure investment landscape in six countries: Canada, China, India, Singapore, the UK and the US. The differences in maturity, transparency and openness to international investment across the six countries present both distinct challenges and opportunities for private investors.

Through a comprehensive series of interviews with investors, developers, policy makers and advisers, the research produced an evidence base to inform the discussion on the growth of private infrastructure provision, on future policy developments and on the evolution of infrastructure as an investment asset class. Findings across the six countries highlight the importance of governments as ‘facilitators’ of private infrastructure investment; providing strategic vision, sustained political commitment and, perhaps most importantly, active project pipelines. In the case study countries examined, the protracted and uncertain nature of infrastructure development pipelines and the complexities in governance frameworks that support infrastructure provision have been considerable barriers to enhanced private investment.

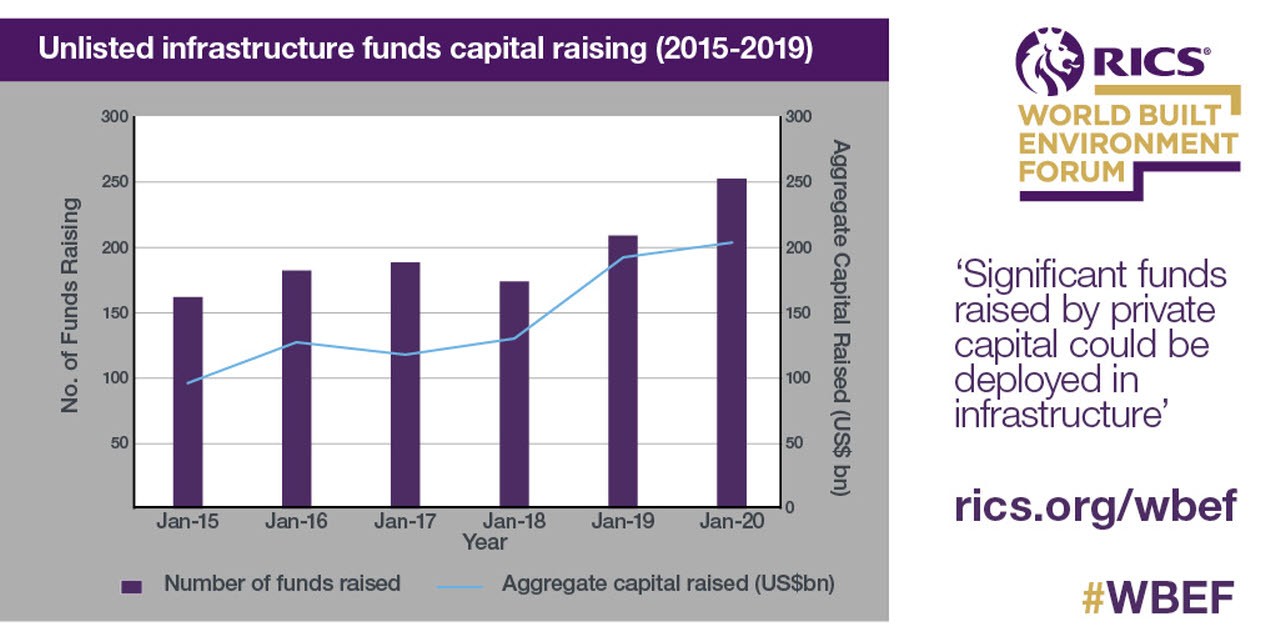

The infrastructure investment landscape has evolved markedly over the course of the last decade to enable more effective alignment of financial vehicles with project opportunities. A surge in new market entrants has prompted the development of innovative investment vehicles and financial structures. With these new market entrants, demand for assurance through standards and accreditation has increased. However, performance benchmarking within the private infrastructure market remains underdeveloped relative to other asset classes.

Given the global nature of the infrastructure market, the seminal work being undertaken by the International Construction Measurement Standards Coalition is a welcome step towards improving data transparency.

Published date: 07 May 2020