Energy crisis, climate change, social inequality – hot topics among business decision makers nowadays. ESG investing has become increasingly popular in recent years as investors look for ways to align their portfolios with their values. This is more than just a trend; it's a way to make a positive impact on the world while still earning returns. An ESG assessment is a comprehensive evaluation of the environmental, social, and governance performance of a business. By systematic assessment it is possible to identify the areas of improvement with regards sustainable operations and environmental impacts.

The “E” in ESG, environmental criteria, includes the energy a company uses, the waste it discharges, all resources utilized and the overall impact on the environment. This is related to carbon emissions a main cause of climate change. “S” stands for social criteria: the relationships a company has and the resulting reputation with society and institutions. This aspect includes labour relations, diversity, and inclusion. “G” stands for governance: the internal system of practices, procedures and controls a company implements, in order to make decisions, comply with laws, and meet the demands of its stakeholders.

There are a number of legislative documents that require companies to disclose non-financial information currently under preparation or in place already. Examples are the EU Taxonomy Regulation (REGULATION (EU) 2020/852 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 18 June 2020 on the establishment of a framework to facilitate sustainable investment), the Corporate Sustainability Reporting Directive (CSRD), the Directive on Corporate Sustainability Due Diligence (CSDD). According to a report by the Organization for Economic Co-operation and Development (OECD), ESG metrics can be broadly organized into the following categories: opportunities (transition to renewables), climate risk management (stress testing and mitigation), outputs (emissions and waste), inputs (resource use), and outcomes (ecology and biodiversity).¹

Investing in real estate presents two key ESG considerations when compared with many other asset classes. Firstly, real estate is usually a long-term investment, allowing more time for material ESG issues to play out in ways that affect investors, the environment and society⁴. ESG data will be the passport of the future for buildings, enabling investors to make informed decisions about asset performance based on benchmarks and frameworks that are critical to their business³. ESG ratings or certifications will also be an important criterion for decision-making by investment fund managers¹.

There are many ESG key performance indicators that are relevant for the construction sector and property development. Some of the most common ones include energy efficiency, water conservation and management, waste management, sustainable sourcing of materials, carbon footprint reduction, biodiversity protection, social impact on local communities and employee health and safety. Such KPIs can be used to measure the environmental impact of construction and property development, as well as the social and governance aspects of such projects.

On the occasion of the 2023 Living Investment Forum, and under the umbrella of the RICS CEE residential working group, an online survey was conducted among large residential developers and management companies from Poland, Czech Republic, Hungary and Romania with help from industry organisations and RICS professional network to get insight on what importance ESG considerations play in the residential sector in the CEE region. 15 responses were collected (a rate of response of 37,5%).

To the question “To what extent are you considering climate and ESG information as primary evidence in decision making?” 80% of respondents claimed that ESG is an important factor in their business decisions at strategy level”, whereas the remaining companies declared that their current priority is “meeting market demand and ESG is considered as far as legislation requires”. Nobody agreed with the statement “ESG as a reporting system is not developed enough to be an integral part of our business decision making system”. When asking “To what extent are you considering ESG for critical decisions on your projects and assets?” 20% responded that they use a comprehensive evaluation of the project’s environmental, social, and governance performance. None of the respondents have a full life cycle carbon assessment model in place for design specifications or for procurement of projects. 40% of respondents assess the company’s energy and water use, evaluate waste management practices, and monitor other environmental factors like emissions caused by construction and transport. An equal number of respondents currently focus only on complying with environmental legislation and to optimize energy efficiency of buildings. No respondent mentioned biodiversity, social impact on future users of the building or maintaining partnerships with local communities.

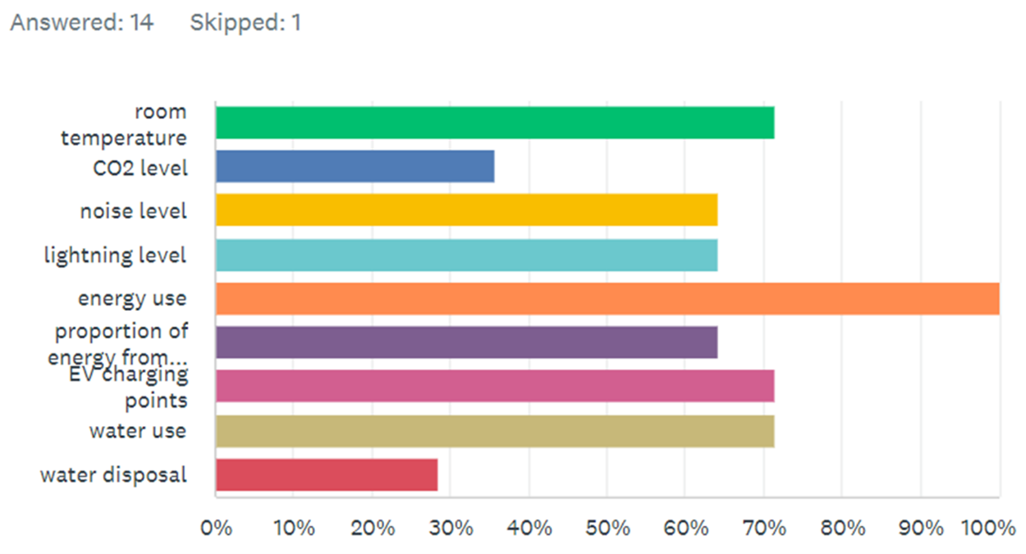

Only one company reported currently using or planning to use whole life carbon assessment, whereas over 70% plans to implement such protocols in the future. The respondents see the main barriers to achieve carbon, ESG, and sustainability targets are the lack of standardized tangible metrics available for use (nearly half of respondents) and that it was difficult to quantify the impacts on project and asset level (almost third of survey respondents). Also, the lack of data and data quality available to perform assessments was mentioned. Non complained about lack or limited availability of third-party evaluation (accredited bodies) to perform such assessments. Lack of data and information may be overcome by sharing relevant data and information. When asking whether the organization shares data and information with other project team members about materials, products, and systems on current projects to promote carbon, ESG, and sustainability goals, a large majority of survey respondents declared sharing data and information, but for business reasons limited to contract partners, whom they normally share technical information. Measurements in place reported were room temperature, energy use, water use, whereas no respondents marked selective waste disposal, or any monitoring and feedback system implemented.

“What are the building performance indicators you implement measurements for?”

To the question on “resources, databases, software, toolkits, and reporting systems, the residential development and management firms use for carbon, ESG, and sustainability evaluation” only a few reactions came: GRESB and CRREM were mentioned. Global Real Estate Sustainability Benchmark collects, validates, scores and benchmarks ESG data. The GRESB Score is used to compare each company against its peers within the parameters of region, sector, or property type. GRESB 5 Stars is the highest rating. The CRREM Risk Assessment Tool allows users to analyse specific real estate assets, and portfolios of these assets, against the decarbonization and energy pathways derived by the CRREM project. The CRREM tool helps to identify which properties will be at risk of stranding due to the expected increase in the stringent building codes, regulation, and carbon prices.

"Compared to the commercial real estate sectors where ESG is more demanded by tenants, in the world of residential real estate, sustainability is only viewed as part of a longer term strategy rather than a day-to-day practice. There are companies in the region who voluntarily implement measures, like green certification of their buildings, as they view this as a way to excel on the market." - added Gábor Soóki-Tóth MRICS, Head of the RICS CEE residential working group.

RICS will continue to monitor ESG related sentiment in the region, working closely together with the local Developers Associations, Green Building Councils, and other like minded organisations and plans to publish aggregated data on a regular basis – added Anna Orcsik, on behalf of RICS in Central & Eastern Europe.

Forrás: Beszélgetés a Binggel, 2023. 04. 28.(1) How to Prepare for ESG Requirements for Your Organization. https://vitality.io/how-to-prepare-for-esg-requirements/ Hozzáférés 2023. 04. 28..

(2) 10 ESG Questions Companies Need to Answer - Harvard Business Review. https://hbr.org/2022/01/10-esg-questions-companies-need-to-answer Hozzáférés 2023. 04. 28..

(3) ESG Ratings: do they add value? How to get prepared? - Deloitte. https://www2.deloitte.com/ce/en/pages/about-deloitte/articles/esg-ratings-do-they-add-value.html Hozzáférés 2023. 04. 28..

(4) ESG reporting and preparation of a Sustainability Report - PwC. https://www.pwc.com/sk/en/environmental-social-and-corporate-governance-esg/esg-reporting.html Hozzáférés 2023. 04. 28..

Forrás: Beszélgetés a Binggel, 2023. 04. 25.(1) Evidence of ESG in the Construction and Development Industry. https://bing.com/search?q=key+ESG+criteria+residential+development+investment Hozzáférés 2023. 04. 25..

(2) An introduction to responsible investment: real estate. https://www.unpri.org/introductory-guides-to-responsible-investment/an-introduction-to-responsible-investment-real-estate/5628.article Hozzáférés 2023. 04. 25..

(3) ESG and Real Estate: The Top 10 Things Investors Need to Know. https://www.cbre.com/insights/reports/esg-and-real-estate-the-top-10-things-investors-need-to-know Hozzáférés 2023. 04. 25..

(4) Evidence of ESG in the Construction and Development Industry. https://mcmillan.ca/insights/evidence-of-esg-in-the-construction-and-development-industry/ Hozzáférés 2023. 04. 25..

(5) ESG and Real Estate: The Top 10 Things Investors Need to Know. https://www.cbre.com/insights/reports/esg-and-real-estate-the-top-10-things-investors-need-to-know?ref=realvantage.co Hozzáférés 2023. 04. 25..

Forrás: Beszélgetés a Binggel, 2023. 04. 28.(1) Improving the construction sector's ESG credentials. https://ww3.rics.org/uk/en/journals/construction-journal/ESG-2023-construction-trends-predictions.html Hozzáférés 2023. 04. 28..

(2) ESG in the construction industry | AGCS - AGCS Global. https://www.agcs.allianz.com/news-and-insights/expert-risk-articles/esg-construction-industry.html Hozzáférés 2023. 04. 28..

(3) ESG reporting and construction industry | EY - US. https://www.ey.com/en_us/real-estate-hospitality-construction/esg-reporting-and-construction-industry Hozzáférés 2023. 04. 28..

(4) Dentons - ESG and the construction industry. https://www.dentons.com/en/insights/articles/2020/march/11/esg-and-the-construction-industry Hozzáférés 2023. 04. 28..

(5) Evidence of ESG in the Construction and Development Industry. https://mcmillan.ca/insights/evidence-of-esg-in-the-construction-and-development-industry/ Hozzáférés 2023. 04. 28..

(6) Measuring Sustainability Performance & ESG KPI's | Accenture. https://www.accenture.com/us-en/insights/strategy/measuring-sustainability-creating-value Hozzáférés 2023. 04. 28..