What is the current state of adoption of artificial intelligence (AI) in the construction sector, and how rapidly is this expected to change?

Using the survey responses of more than 2,200 professionals globally, this report examines current attitudes toward AI in the construction sector and recommends actions to accelerate progress and ensure responsible AI integration.

It presents the results of a previously unpublished subset of six questions that formed part of the Q1 2025 Global Construction Monitor (GCM) survey.

“This timely report provides a valuable global snapshot of how surveying professionals across the built and natural environment are thinking about AI in construction, where they see significant potential, what’s holding them back and how prepared they feel. These sentiment-based insights help us cut through the hype and focus on what matters: ensuring AI is used in ways that support trusted and safe practice, deliver real value and serve the public good.”

Maureen Ehrenberg FRICS CRE

Acting President-Elect, RICS

The construction industry stands at an unprecedented inflection point.

The convergence of accessible tools, growing data maturity, mounting pressure for productivity gains and a clear improvement in social and environmental outcomes has created the conditions for rapid, widespread adoption of AI.

This report reveals that the industry is closer to this transformation than many realise, with the potential for AI integration to accelerate dramatically within the next 12 to 24 months.

Organisations that understand and act on these patterns will gain significant competitive advantages, while those that delay risk being left behind in an increasingly AI-enabled marketplace.

1 Introduction

AI can be defined as ‘digital systems capable of performing tasks requiring human-like intelligence, such as learning, reasoning and inferring’. The field has seen rapid progress in the last few years.

While intelligent digital systems (such as computer vision) have been in use in construction for several decades, more recent breakthroughs in deep learning architecture and the subsequent release of free-to-use web-based generative AI tools have propelled AI, and its potential use on the construction industry’s ‘wicked’ problems (defined by their complexity, additionality and data availability), into the limelight.

As a technology that is rapidly evolving, AI has the potential to reshape the construction industry, bringing both risks and opportunities. At the forefront of industry leaders' minds are the implications of AI for professional skills and expertise, productivity, job security and displacement, health and safety, security and sustainability.

2 Survey and responses

To assess the current state of AI adoption in the sector, as well as how prepared the industry is to address the risks and capitalise on potential opportunities, professionals responding to the Q1 2025 Global Construction Monitor (GCM) survey were asked to share their experience in six areas:

- their organisation's current level of AI adoption in construction projects

- how prepared their organisation is to implement AI solutions in construction projects

- how significant they believe AI could be in improving various aspects of their construction projects

- their organisation's primary barriers to AI adoption

- the emerging areas in which they expect AI to impact their construction projects most over the next five years and

- their organisation’s AI investment plans for the next 12 months.

More than 2,200 responses were received. By world region, 48% came from the UK, 19% from Asia Pacific (APAC), 14% from the Middle East and Africa (MEA), 10% from the Americas and 8% from Europe.

Data from a second survey (the RICS Q2 2025 skills survey) is also presented in this report. Responses from more than 2,000 professionals worldwide to questions relating to the perceived impact of AI on professional skills and employment are shown in section 3.7.

All survey questions and response options were designed to minimise sentiment bias, social bias and response bias. Responses from the online surveys were analysed using a spreadsheet tool.

3 Findings

Findings from the analysis of sentiment-based responses are presented below.

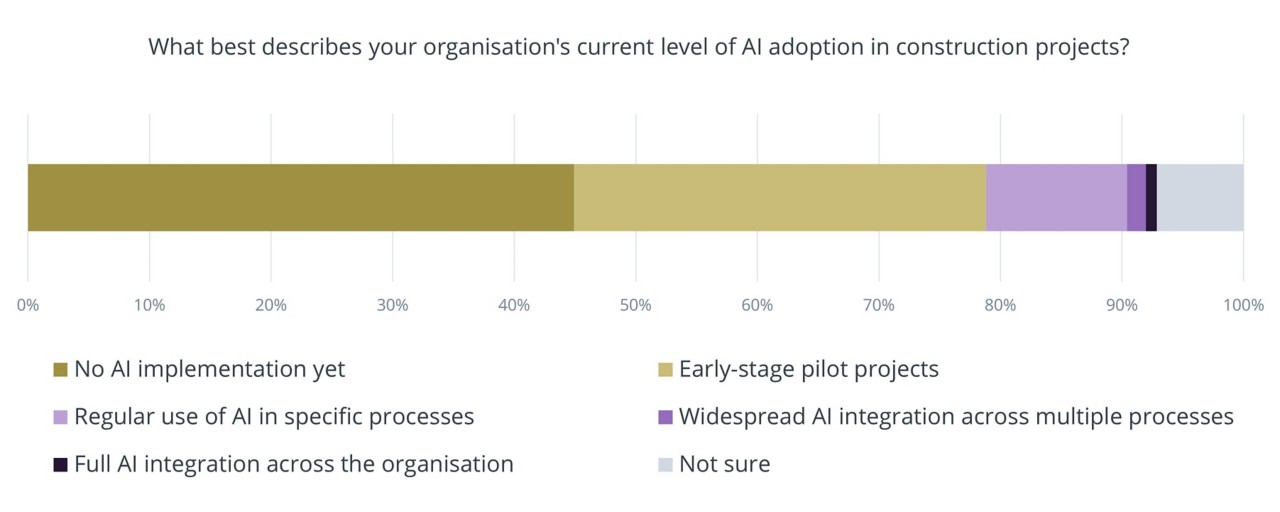

3.1 Respondents report very limited AI adoption among construction organisations globally

In 2025, AI emerged as the leading construction technology for increased investment, with 56% of surveyed investors planning to allocate more funds to AI compared to the previous year. Despite the increasing attention on AI within the construction sector, actual adoption remains limited (see Figure 1). Approximately 45% of respondents reported no AI implementation in their organisations, while another 34% are in early pilot phases, highlighting cautious experimentation rather than widespread operational use. This tentative approach suggests the industry recognises AI's potential benefits but remains uncertain about scalability, integration or business value.

More frequent use of AI on construction projects is still relatively rare. Just under 12% of respondents reported regular use of AI in specific processes, indicating pockets of successful deployment in certain operational areas. However, widespread adoption remains rare: only 1.5% reported use across multiple processes, and fully embedded, organisation-wide AI use was reported by less than 1% of participants globally. This sharp drop-off suggests significant barriers to scaling AI use, including skills gaps, integration challenges, data availability and high implementation costs.

Additionally, the 7% of respondents who were unsure about their organisation’s AI adoption status may appear insignificant at first glance but could point to deeper underlying issues. This uncertainty may stem from AI capabilities being embedded in tools without clear labelling, a lack of formal communication around AI use or the absence of structured strategies to guide implementation. Such ambiguity within organisations can be remedied by more transparent internal communication, defined governance frameworks and practical training to ensure AI use is transparent, intentional and aligned with broader business goals.

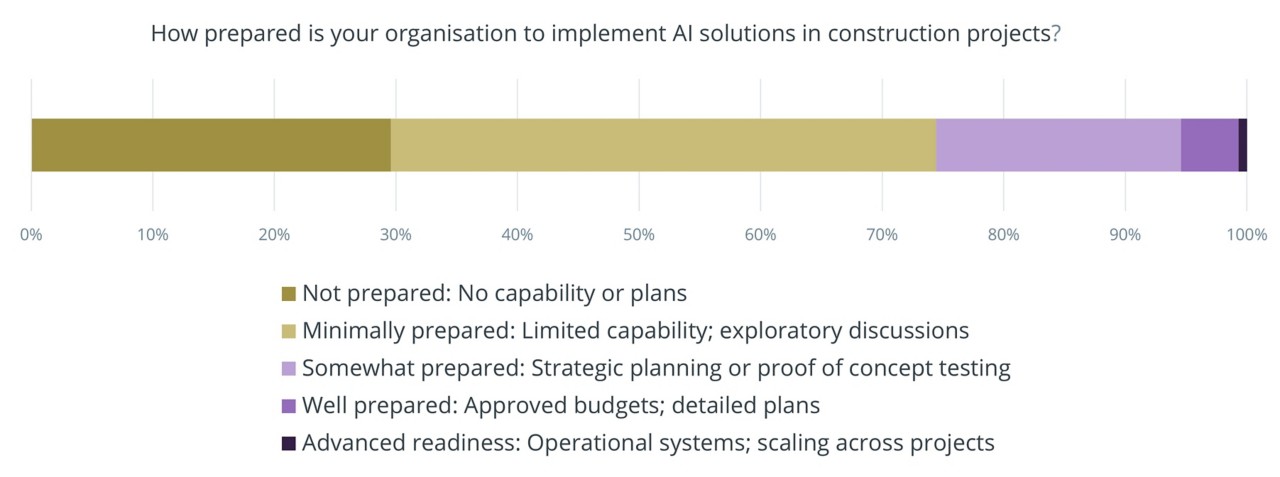

3.2 AI preparedness remains low across the construction sector

While industry interest in AI is rising, the construction sector remains in the early stages of organisational readiness. Survey results indicate that nearly three-quarters of companies have yet to move beyond initial discussions or have no capability or planning activity related to AI adoption (see Figure 2). Specifically, 45% of respondents report their organisations have limited capability and are only exploring how AI might be implemented. An additional 29% say their organisations currently have no capability or plans in place.

This heavy concentration in the lower levels of preparedness suggests a lack of strategic direction and foundational AI capability. It reflects a sector that is aware of AI’s potential but has not yet made the structural or cultural shifts required to implement it at scale.

Only around 20% of respondents reported that their organisation is engaged in strategic planning around AI and undergoing proof-of-concept testing of AI solutions. This is a critical transition point, signalling intent but not yet execution.

A much smaller proportion of respondents said their company was making specific plans or was in active deployment. Under 5% said their organisation was at the stage where they had budgets approved and detailed implementation roadmaps.

A very small percentage (less than 1%) of respondents globally described their organisation as having operational systems in place, where AI was being scaled across projects.

These figures point to the rarity of AI maturity in the sector. The distribution of responses highlights variation in how prepared organisations are to adopt AI. While a smaller group of firms report being engaged in strategic planning or implementation, the majority remain in early exploratory stages or have no capability in place. This variation may reflect an emerging divide between firms beginning to take concrete steps and those still assessing their position.

Overall, the data suggests that while interest in AI is growing, it is not yet consistently supported by capability-building or defined implementation plans. To move from exploration to execution, organisations will likely need clearer strategies, targeted skills development and internal structures that support responsible AI adoption.

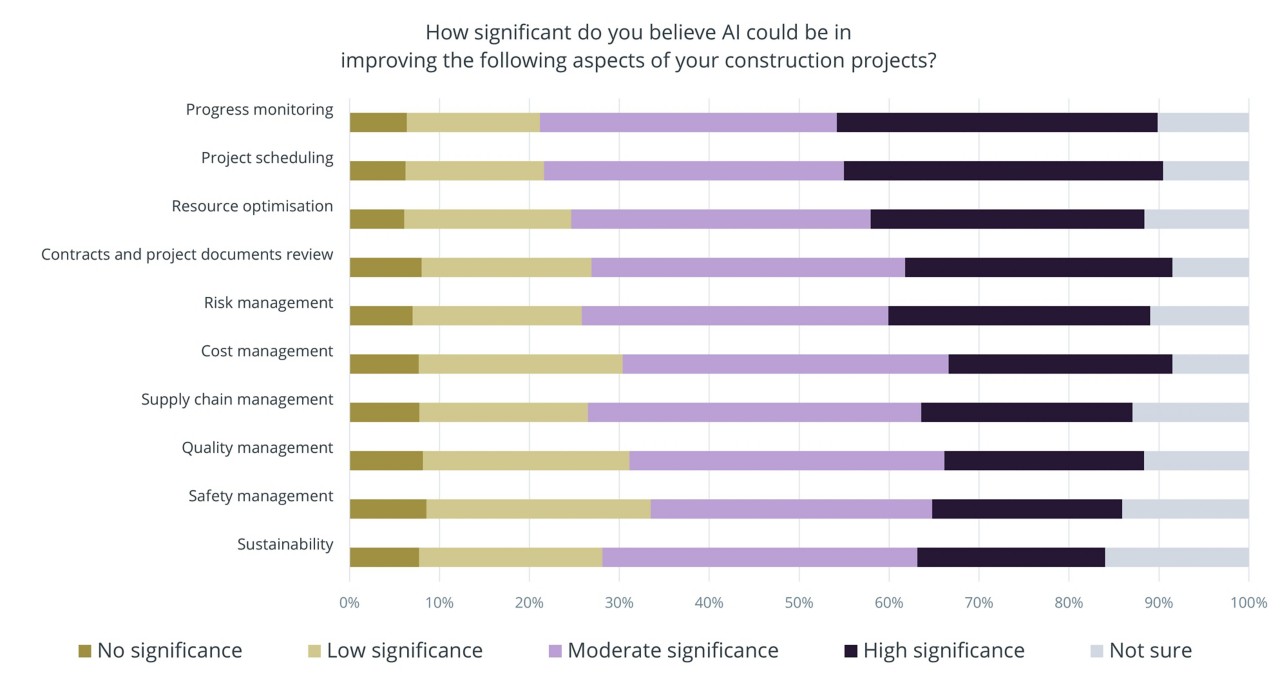

3.3 Professionals believe AI could improve most aspects of construction projects

The professionals surveyed believe AI could significantly improve several aspects of construction projects. Among the ten areas evaluated, most respondents rated AI’s significance as moderate to high, particularly in those domains already associated with data-rich processes and predictive decision making (see Figure 3). Globally, the top five ranked project functions where AI could have high positive significance were:

- progress monitoring and project scheduling (both 36%)

- resource optimisation (30%) and reviewing contracts and project documents (30%) and

- risk management (29%).

Following these, cost management ranked sixth (25%), supply chain management seventh (24%) and quality management eighth (22%). Respondents believe AI has the least potential to significantly improve safety management (21%) and sustainability (21%).

While sustainability and safety management trail slightly behind other core areas of project execution, they still received a significant percentage of favourable responses. Their position as the lowest-ranked areas on this question may reflect current limitations in AI’s integration with upstream design tools and downstream supply ecosystems.

Nevertheless, the relatively low expectations for AI’s positive impact on sustainability and safety management warrant deeper examination, as this counterintuitive finding suggests several concerning possibilities: limited awareness of AI's potential in these critical areas, insufficient integration between AI strategies and sustainability objectives, or a fundamental misunderstanding of how AI can enhance safety and environmental performance. Given the mounting pressure to improve both sustainability and safety outcomes, this perception gap may represent a substantial missed opportunity. Organisations that successfully apply AI to these areas may gain significant competitive and regulatory advantages over others who focus on more obvious applications.

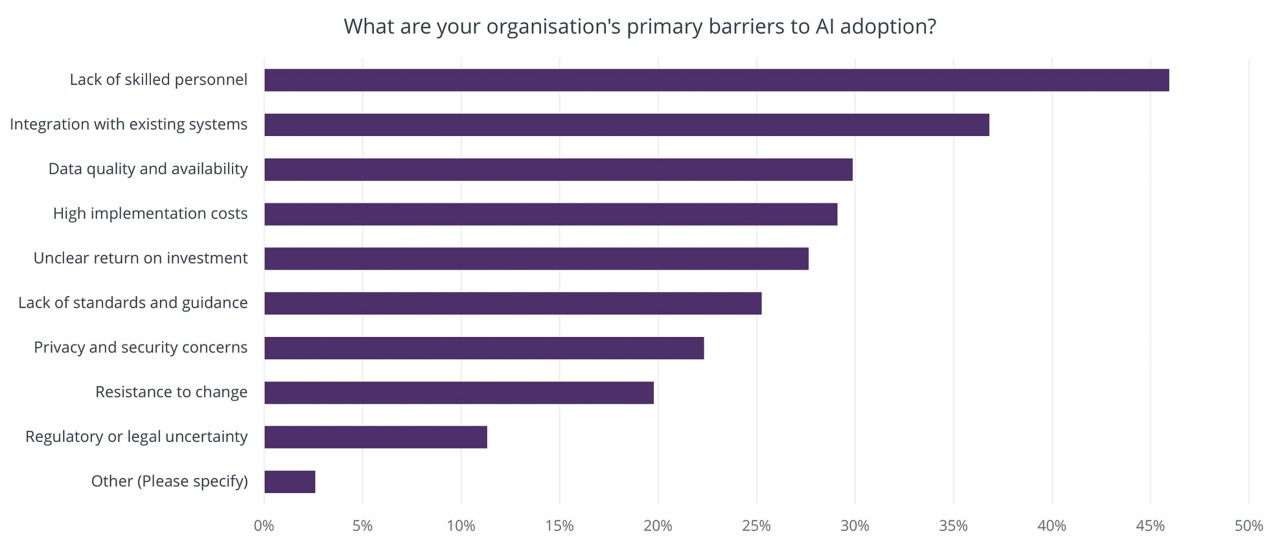

3.4 Lack of skilled personnel is the most cited barrier to AI adoption

Despite growing interest, several practical barriers constrain AI adoption in the construction sector. When asked to list their top three challenges, the following were selected most frequently by respondents (see Figure 4).

- Lack of skilled personnel (46%).

This points to a widespread talent gap or lack of AI literacy across the sector worldwide. This may reflect a broader shortage of digital skills within construction, as well as limited availability of training tailored to AI in real-world project contexts.

- Integration with existing systems (37%).

This indicates companies' desire to ensure that the AI systems they adopt will work with their current solutions, underscoring the need for interoperable systems, flexible integration options and greater transparency from technology vendors to support adoption.

- Data quality and availability (30%).

This is a foundational requirement for effective AI use, as high-quality, structured data is essential for fine-tuning and deploying AI models. However, many firms still struggle with fragmented, incomplete or inconsistent data. This barrier may be especially acute in small and mid-sized organisations with limited digital infrastructure.

High implementation costs, selected by 29% of respondents, and unclear return on investment (28%) reflect concerns about financial risk and uncertainty. These rankings suggest that many entities remain unconvinced of AI’s near-term value or are hesitant to commit funding without proven results. The novelty of AI solutions, lack of case studies and variable vendor offerings may contribute to this uncertainty.

Lack of standards and guidance (25%) reinforces the perception that the AI landscape is still emerging, with few established best practices in the construction context. This may leave firms unsure of how to assess or govern AI use responsibly.

The lowest-ranked barriers globally are:

- regulatory or legal uncertainty (11%)

- resistance to change (20%) and

- privacy and security concerns (22%).

These lower-ranked barriers may appear less pressing today but could grow in importance as adoption increases. Their current ranking may reflect limited real-world exposure to AI applications, or a lack of awareness of how emerging regulations could affect future use.

Barriers listed under ‘other’ generally related to AI being irrelevant to the organisation’s services or to distrust of the technology in its current stage of development.

All these barriers do not operate in isolation but create compounding effects that can significantly delay adoption. The skills shortage directly impacts integration capabilities, while poor data quality undermines the business case needed to justify high implementation costs. To achieve successful AI adoption, organisations will need to address these barriers systematically rather than in isolation.

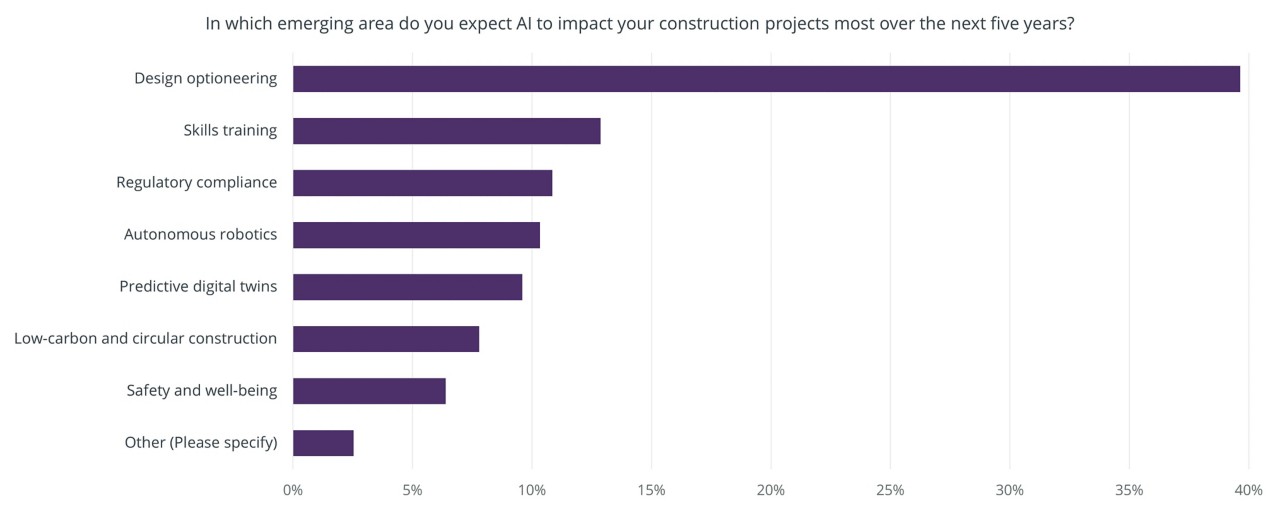

3.5 Professionals expect AI to have the most significant impact on design optioneering

Over the next five years, construction professionals expect AI to have the most significant impact in a few high-potential areas. Respondents were asked to select the one area where they anticipated AI would have the most significant influence (see Figure 5), and the results revealed a noteworthy shift: while AI is currently viewed as most valuable in tactical areas such as progress monitoring and scheduling (see Figure 3), professionals anticipate its future impact will be greatest in strategic functions like design optioneering. This reflects growing optimism about AI's role in shaping early-stage decision making rather than simply improving execution later in the project life cycle.

- Design optioneering (40%). With remarkable global consensus across the construction industry, this area was selected as being where AI's primary value proposition lies. With growing pressure to build smarter and faster, AI-led design evaluation could become the next frontier of competitive advantage.

- Skills training (13%). The survey participants’ responses suggest an industry recognition that AI could help address the workforce development challenges identified as current barriers to adoption in section 3.4. It also indicates that respondents see AI adoption requiring new skills from construction professionals, while at the same time providing the sector with new solutions for skills development.

- Regulatory compliance (11%), autonomous robotics (10%) and predictive digital twins (10%). These areas occupy the middle tier of expectations and represent more specialised AI applications that may require longer development cycles or more significant changes.

- Other focus areas included low-carbon and circular construction (8%) and safety and well-being (6%).

Areas listed under ‘other’ include document drafting, operational efficiency and ‘none’.

The dominance of design optioneering as the expected primary AI impact area reflects the industry's current understanding of AI's most immediate and tangible applications. However, the low expectations for AI to impact safety and well-being and low-carbon and circular construction (also reported in section 3.3) reveal a concerning strategic near-sightedness.

Given the importance of safety and sustainability in the industry, organisations that fail to recognise AI's transformative potential in regulatory compliance, risk management and environmental performance could miss opportunities and suffer competitive disadvantages.

The industry's focus on design optimisation, while valuable, may be too narrow to capture AI's full strategic potential. To shift this perception, RICS recommends targeted demonstration projects and clearer benchmarks (see section 4).

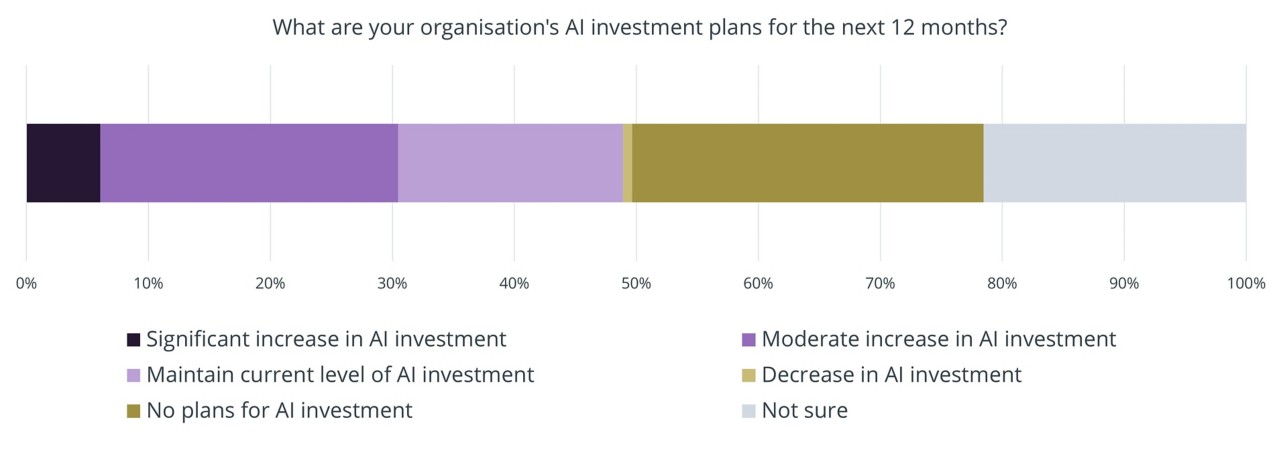

3.6 No global consensus among construction companies on how much to invest in AI

The construction industry's approach to AI investment reveals a sector at a critical crossroads. The results indicate no clear consensus among companies on whether, how much or where to invest in AI (see Figure 6), and there are significant regional variations in funding commitment.

No clear investment consensus emerges globally, with responses distributed across multiple investment approaches. The largest single group (28%) reports no plans for AI investment, while nearly as many (25%) plan moderate increases in AI investment. This near-equal split demonstrates the construction industry’s uncertainty about AI's value proposition and where, when or how to implement it.

Investment intentions also show significant fragmentation, with 22% of respondents unsure about their organisation’s AI investment plans and 19% saying their company plans to maintain current investment levels. Only 6% anticipate significant increases in AI investment, while just 1% plan to decrease investment, suggesting a minimal retreat from current positions.

Interestingly, around 22% of respondents selected ‘Not sure’ when asked about their organisation’s AI investment plans. This relatively high level of uncertainty may point to several factors. It could reflect limited awareness among some professionals about strategic decisions within their company, or the absence of formal reporting or communication regarding AI-related investments. It may also indicate broader industry uncertainty about how AI will evolve and how or when it will be implemented at scale.

As with any sentiment-based survey, response bias or incomplete knowledge among respondents is also a possibility. Although the survey did not explicitly explore internal communication or governance practices, the high rate of uncertainty suggests that in some organisations, AI-related initiatives may be taking place without clear visibility across teams. It is also possible that some AI tools are embedded in existing digital platforms without being clearly identified, making it difficult for professionals to fully understand the extent of adoption or investment.

These conditions can make it challenging for companies to establish accountability or ensure consistent, responsible use. This underscores a broader challenge highlighted in 2025 by a survey from CMS, which showed that the industry lacks widely shared, transparent practices for tracking and communicating AI use. Addressing this will require three key interventions:

- clear company policies mapping how AI is being used internally and externally

- practical guidance or standards for staff to use AI responsibly and transparently, and

- greater industry dialogue and openness around AI use cases and investment plans.

While AI adoption is advancing, pathways to implementation remain fragmented. Strengthening governance, communication and shared learning will be essential for responsible, coordinated progress.

3.7 High reported optimism, yet some concern, among RICS members about the influence of AI on skills

Preliminary data from a recent RICS skills survey reveals a high level of optimism among RICS members about the potential for AI to deliver greater value in the future (Table 1). The survey, which was conducted in Q2 2025 and received more than 2,000 responses worldwide, revealed that 69% of project managers (PMs) and 67% of quantity surveying (QS) and construction professionals agreed that AI will help surveyors to deliver greater value in the future.

RICS members also reported a fairly high level of concern and feeling overwhelmed by AI and its impact on their job roles and the profession more widely. Forty-four percent of the PMs and 38% of the QS and construction professionals surveyed reported concerns about the impact of AI on their own role. Similarly, 48% of PMs and 41% of QS and construction professionals agreed that they feel overwhelmed by how quickly technology is changing the surveying profession.

RICS skills survey statement |

% of respondents who agree |

|

Project managers |

Quantity surveying and construction |

|

AI will help surveyors deliver greater value in the future. |

69% |

67% |

I have concerns about the impact of AI on my own role. |

44% |

38% |

I feel overwhelmed by how quickly technology is changing the surveying profession. |

48% |

41% |

Table 1: RICS skills survey Q2 2025, AI-related findings

These results point to a profession that views AI as a transformative force, even as it brings uncertainty and demands adaptability.

4 Cross-cutting insights

This section identifies patterns and relationships between the survey responses, offering a broader view of where the industry is heading. It highlights emerging trends and suggests possible implications for AI adoption.

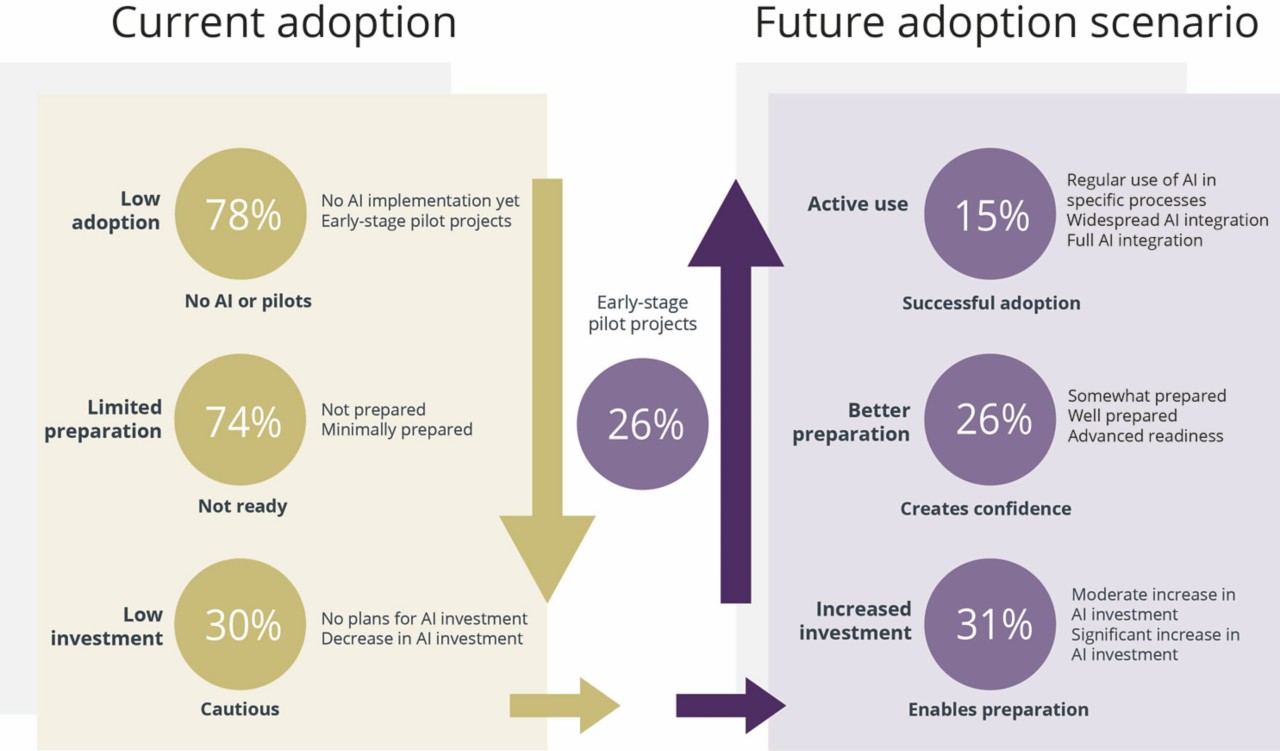

The findings reveal an industry at a key moment in its digital transformation journey. While AI adoption remains in its early phases globally, with 78% of organisations either having made no implementation or being only in pilot project stages, the survey uncovers patterns of adoption that are likely to shape the industry's future.

Analysis was conducted using a spreadsheet tool, comparing responses to the adoption, preparedness, barriers and investment questions to identify common themes. When cross-referencing responses, the data points to two emerging industry patterns:

Investment intentions exceed adoption rates across all global regions

As outlined in section 3.1, current levels of AI adoption remain limited, with most firms in exploratory or non-adoption phases. Yet, as shown in section 3.6, a notable share of respondents reported plans to increase investment, suggesting strategic ambition outstrips present capability. Taking the global average, there is a 16-percentage-point gap between stated future investment plans (31%) and current adoption (15%). One reading of these results would be that the construction industry plans to accelerate its AI adoption in the near term.

Investments in AI are planned despite widely acknowledged skills shortage

Around 30% of respondents globally who cited skills shortages as the main barrier still plan to increase their investment in AI in the next 12 months. This is particularly notable as lack of skilled personnel is the most commonly cited barrier to AI adoption, being named by 46% of respondents (see section 3.4). For some companies, the rationale of investment before upskilling may reflect an assumption that skilled people can be recruited more quickly than existing staff are upskilled, whereas investment planning takes places over a much longer timescale.

The construction industry already faces longstanding challenges with skills shortages, exacerbated by an ageing workforce and a shortage of young skilled professionals. In an industry where professionals with a mix of skills in AI and construction are the most sought after, choosing to recruit new talent over investing in upskilling their existing workforce may disadvantage some companies. AI implementation without an appropriately skilled workforce poses a risk to the effectiveness of any strategy.

With AI-related skills and competence rapidly moving from ‘nice-to-have’ to essential, employers will need to consider how they can best attract and retain this talent in a limited skills market. Professionals not familiar with AI should consider upskilling to ensure they are not left behind in an increasingly AI-enabled workplace. Meanwhile, new and/or younger entrants to the sector, who may be more comfortable working with digital tools and more willing to adopt AI into their ways of working, will likely see demand for their skills and competence grow rapidly in the coming years.

As shown in section 3.5, design optioneering is viewed as the area in which AI will have the highest potential impact over the next five years. This builds on the current perceptions reported in section 3.3, which showed that AI is expected to be significant in improving data-rich functions such as scheduling and progress tracking.

While industry-wide consensus reveals confidence in the use of AI for specific construction applications such as design optioneering, a lack of appropriate workforce skills coupled with concerning gaps in the perceived value of AI to improve safety and wellbeing (6%) and low-carbon and circular construction (8% (see section 3.5)) poses risks to companies who may end up missing key opportunities. These companies may also lose out on the efficiency gains possible from well-designed AI adoption plans in practice areas critical to the industry’s future.

There are some encouraging signals from the underlying trends in the data concerning adoption, preparation and future investment (see Figure 7). On one hand, the data reflects a prevailing attitude of caution: 78% of respondents currently report low adoption, and this majority of non-adopters in the market is reinforced by 74% indicating limited or no preparation. A lack of preparation reflects an industry not ready to take up AI, and 30% citing low planned investment reflects a sector that is currently in the early stages of adoption and implementation.

On the other hand, the data suggests that industry change is on the horizon. Currently, 26% of respondents say their company is well on the way towards preparation, a process that should provide the confidence to invest in and adopt AI. Thirty-one percent of respondents also report a moderate or significant increase in investment planned over the next 12 months. With adequate investment and preparation, companies currently in the early-stage pilot project phase (34%) may soon become successful and active users of AI. Combined with those who reported that their company is already actively using AI (15%), this suggests that nearly 50% of respondents could integrate several forms of AI technology into their business processes within a relatively short period.

These trends suggest the construction industry is reaching an AI tipping point. As supporting infrastructure develops, processes and practices become established and implementation costs reduce, widespread AI adoption could occur over a relatively short timescale.

5 Recommendations

The survey results reflect an industry beginning to find its footing with AI. However, meaningful adoption will require companies to take coordinated, well-communicated and intentional action supported by a clear, coordinated roadmap.

To accelerate progress and ensure responsible AI integration, we recommend a joined-up strategy and a clear roadmap led by industry stakeholders, supported by government and RICS action.

Immediate-term action (2025 to 2026) |

|

In this phase, organisations build the internal readiness, clarity of purpose and data infrastructure needed for informed and responsible AI use. This includes establishing a foundational commitment to ethical principles and public interest safeguards from the outset. |

|

Leadership by industry |

Support by government and RICS |

|

|

Table 2: Immediate action

Medium-term action (2027 to 2028) |

|

With foundational work in place, the focus can shift to applying AI at operational scale, underpinned by ethical safeguards, investment alignment and performance evaluation. |

|

Leadership by industry |

Support by government and RICS |

|

|

Table 3: Action in the medium term

Long-term action (2029 and beyond) |

|

The long-term phase focuses on scaling what works, contributing to broader industry alignment and helping shape an open, interoperable AI ecosystem across the built and natural environments. |

|

Leadership by industry |

Support by government and RICS |

|

|

Table 4: Action in the long term

References

Responsible use of artificial intelligence in surveying practice

Artificial intelligence: what it means for the built environment, RICS, October 2017

Digital twins from design to handover of constructed assets, RICS, March 2022

RICS digitalisation in construction report 2024, November 2024

RICS sustainability report 2024, November 2024

Related articles

Wicked problems in construction: how the intelligent use of AI can help, World Built Environment Forum, RICS, February 2025

Wicked problems in construction: the main problems that AI can help solve, World Built Environment Forum, RICS, February 2025

Wicked problems in construction: managing the risks posed by AI, World Built Environment Forum, RICS, February 2025