Rising costs will put pressure on the facilities management sector over the next five years.

The BCIS five-year (3rd quarter 2019 to 3rd quarter 2024) forecasts for the facilities management sector are:

- maintenance costs to rise by 19%

- cleaning costs to rise by 26% and

- energy costs to rise by 6% (based on annual averages 2018 to 2023) *.

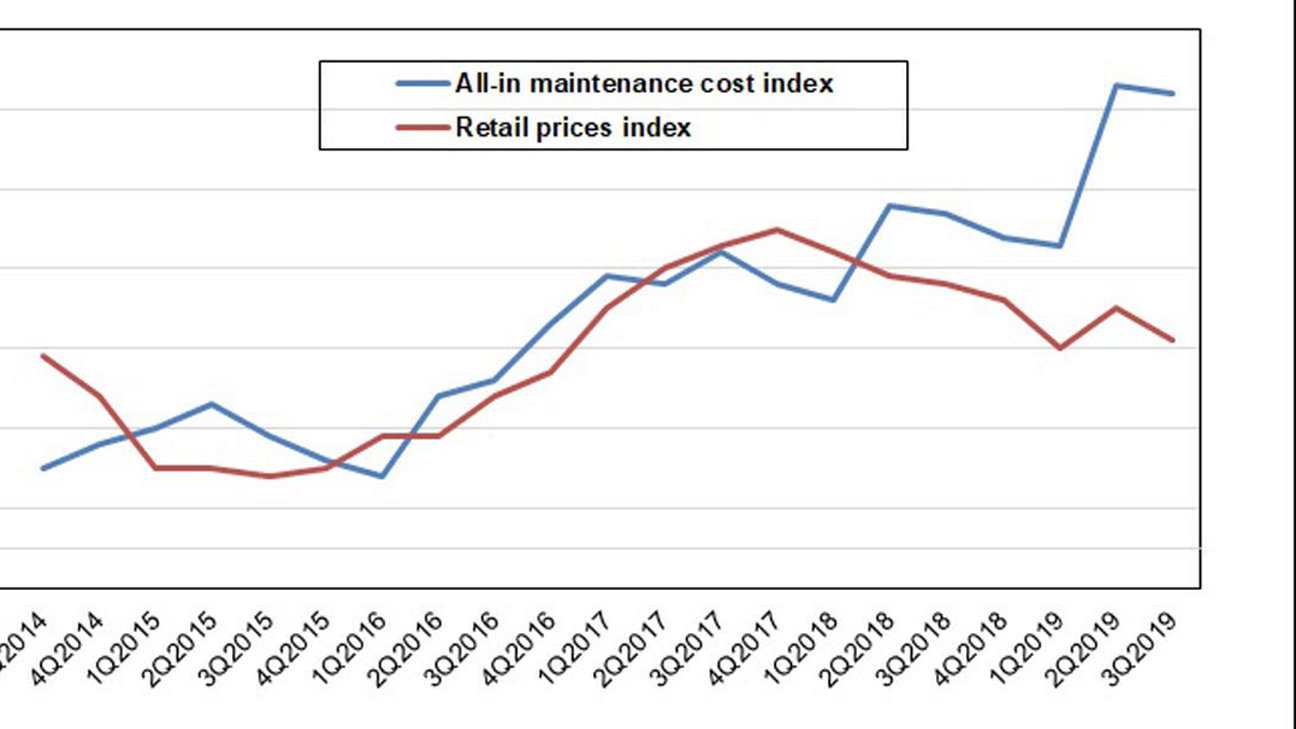

Maintenance costs

Maintenance costs, as measured by the BCIS All-in Maintenance Cost Index, rose by 5.7% in the year to 3rd quarter 2019. The annual rate of growth in costs is expected to fall to 4.9% in 3rd quarter 2020 and then to slow to between 3-4% for the rest of the forecast period.

Maintenance costs and inflation

Repair and maintenance (R&M) output is forecast to rise by 1.2% in 2020, 1.9% in 2020, 1% in 2021 and around 3% over each of the following three years.

Maintenance prices are forecast to rise by around 3% in the year to 3rd quarter 2020, followed by an annual increase of 5% in the year to 3rd quarter 2021. Over the final three years of the forecast period, with sharper growth in total construction output and increasing pressure from input costs, prices are forecast to rise by close to 5% per annum in the years to 3rd quarters 2022, 2023 and 2024.

Cleaning costs

Cleaning costs rose by 4.5% in the year to 3rd quarter 2019, mainly due to the increases in the national living wage (NLW). Costs are forecast to rise by 6.5% in the year to 3rd quarter 2020 and by close to 5% per annum over the remainder of the forecast period, with pressure for the NLW to continue to rise faster than inflation.

Energy prices

Energy prices are largely driven by the global market and taxes, and as such are not likely to be affected by the UK leaving the EU. However, a fall in sterling will raise the price of imported fuel and energy. Sterling exchange rates remain depressed compared with the pre-referendum rates. It is assumed that they will stay depressed after the end of any transitional period, improving gradually thereafter. As they improve, prices for imported fuel and energy will fall. However as recent events in the Middle East have shown, oil prices are subject to political events and will continue to be volatile.

There is still a great deal of uncertainty over the terms that will be agreed when the UK leaves the EU. The government's Brexit agreement has recently been passed by parliament and a transitional period has been agreed with the EU to 31 December 2020. Even if the UK leaves the EU with an agreement, there will still be a large number of unknowns to be sorted out during a very short transitional period.

While almost any outcome is still possible, BCIS will continue to produce forecasts based on three scenarios. These reflect the different outcomes from the exit negotiations from the EU and are equally likely. The uncertainty of the results of the Brexit negotiations will undoubtedly lead to BCIS revising its assumptions again as more is known. More details of the three scenarios can be found in the BCIS Quarterly briefing, January 2020.

* Energy cost projections are based on annual averages. As the price of oil is key to the majority of energy costs, these projections are based on the 2018 Fossil Fuel Price Assumptions published annually by the Department for Business, Energy and Industrial Strategy (BEIS).