The built environment sector faces a desperate need to become more sustainable. The World Green Building Council estimates that the building and construction sector accounts for 39% of global carbon emissions. The challenge is clearly sizeable, but it also means the sector is ideally placed to take a leadership position in the global drive towards sustainability. The environmental and ethical case to do so has never been stronger.

A circular economy, which seeks to decouple economic growth from resource consumption, presents a valid alternative approach to sustainability in the built environment. Minimising waste, keeping products and materials in use for longer, and regenerating natural systems will clearly bring environmental benefits.

Less well articulated is the business case.

Our own research shows us that a business’ consumers and prospective employees increasingly expect it to act in a socially and environmentally responsible manner. But what are the financial benefits of doing so? Making the investment case is vital to turbocharging the adoption of circular economy principles, helping the sector tackle its environmental footprint and create better places for people to live and work. So too is practicality. What tangible changes could real estate investors and businesses make to tap into these benefits?

With these questions in mind, Arup and the Ellen Macarthur Foundation’s latest report “From principles to practices: Realising the value of circular economy in real estate” marks an important step forwards, as does the cross-industry collaboration that has supported its creation. Indeed, I am pleased that RICS has been able to help develop the five circular economy real estate business models outlined in the report.

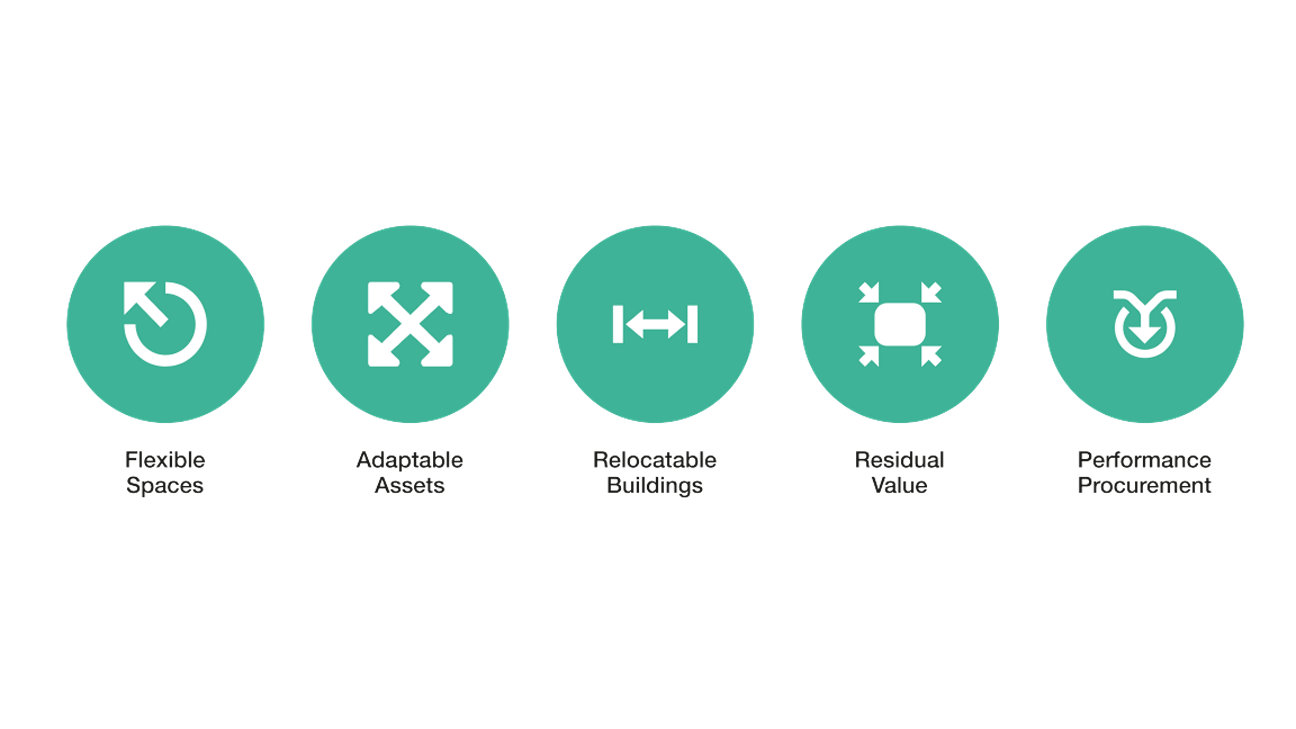

These comprise of:

- Flexible spaces - The listing and short-term use of underutilised building spaces on online platforms

- Adaptable assets - Buildings that can accommodate multiple uses within their lifecycle through retrofit

- Relocatable buildings - The deployment of temporary, modular buildings on unused sites to create short-term spaces

- Residual value - Creation of a new commodity futures contract to allow transfer of ownership of materials contained within building on a centralised exchange

- Performance procurement - Extending the product-as-a-service model seen in individual systems such as lighting, to the building level.

The five business models

The circular economy in practice

This latest research doesn’t just demonstrate that circular economy practices can be built into existing real estate business models; it highlights the benefits of doing so, whether creating new value from an asset, keeping an asset at its highest value, or eliminating waste.

At their core, the five business models developed support the optimal use of resources across a real estate asset’s lifecycle, rather than simply at the design stage. This will mean RICS professionals will be uniquely placed to realise circular economy practices. Among the other built environment professions, it is our profession alone that is engaged at every stage of an asset’s lifespan.

The successful adoption of circular economy practices will be heavily dependent on the buy-in of investors. So, the importance of investors’ risk perception and appetite, as well as their understanding of an asset’s financing, can’t be overlooked. Valuation standards are integral to building investors’ trust. Applied by trusted professionals, they aid transparency and give investors confidence in the underlying valuation.

“Making the investment case is vital to turbocharging the adoption of circular economy principles, helping the sector tackle its environmental footprint. ”

Sean Tompkins

Chief Executive, RICS

Adapting to circular economy practices, and the techniques this will require, will drive broader adoption of new tools among RICS professionals. The profession is already closely involved with several innovations, whether buildings passports or digital twins. Blockchain, to assure the provenance of materials, will also become part of the toolkit. Throughout this, RICS will continue to advance the future of the profession, providing it with the guidance and resources that will be required match the needs of the evolving landscape they work in.

As a global industry and for the benefit of future generations, we have to deliver the sustainable cities that a growing global population requires. Working together, we can pioneer better built environments at the same time as meeting the challenges that rapid urbanisation brings.

This means embracing innovation. It’s often all too easy to see change as a threat, rather than an opportunity. But as the research shows, those who are bold enough to blaze a trail will ultimately deliver greater value for their clients and gain competitive edge.

About the author

Sean Tompkins

Chief Executive Officer, RICS

Sean has been Chief Executive of RICS since September 2010. Sean has transformed RICS from a traditional, trusted UK mark of professionalism built on high standards and ethics to one of international recognition, influence and thought leadership. From governments to financial institutions, RICS’ standards, qualifications and thought leadership are respected and recognised. As well as advancing RICS’ strategy and goals, Sean is also a passionate champion for greater diversity and inclusion within the profession.