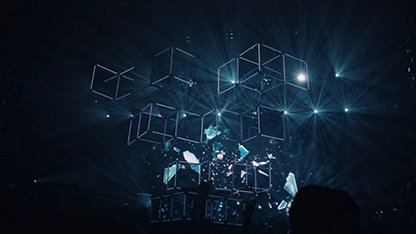

Making order out of disruption.

Digitalisation is transforming our interactions and transactions, habits and habitats. In this new age of possibility, we are both more connected and more divided than ever before. What does the fourth industrial age mean for the built and natural environment?

A more equitable future is within reach. First, we must harness the enormous potential of the 21st century’s people, places and spaces. #WBEF

Latest Insights

Applied filters:

Clear all filters

Showing 1-10 of 65 results