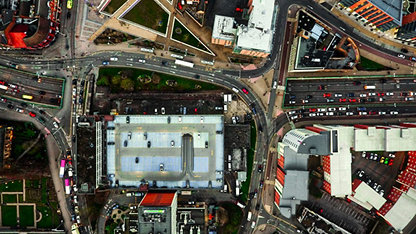

The built environment's forum for the future.

The World Built Environment Forum is an initiative of RICS, the leading international professional body in the sector. We have a formal public interest remit and our work aims to ensure that markets operate in the best interests of society.

Our mission is to advance discussions of critical importance to the built and natural environment, inspiring positive and sustainable change for a prosperous and inclusive future.

Upcoming WBEF Webinars

Webinar

Housing markets in 2024 and beyond: How can the sector leverage change?

• 1 Hour Formal CPD • Online

Free

Webinar

Business integrity in real estate: Tackling illicit financial flows

• 1.0 Hour Formal CPD • Online

Free

The future of real estate valuations: The impact of ESG

How can we truly embed ESG requirements into real estate valuations? Given the huge climate and social challenges we are facing globally, we need to move to a market where ESG is firmly embedded and reflected in valuations.

Written by experts from the RICS Europe Leaders’ Forum, this paper and its accompanying data list examine the current legislative situation and market drivers around ESG and valuation in Europe.

Access the latest industry insight examining the current legislative situation and market drivers around ESG and valuation in Europe.

Latest megatrend insights

Lightning talks

Past WBEF Conferences

Megatrends

Exploring the issues that will define the world for decades and generations to come