Develop your knowledge and skills with RICS training & events.

Explore conferences, seminars, training and networking options covering all aspects of surveying practice within the built and natural environment. Keep up to date with the latest information and guidance on current topics and find practical support to help you remain compliant and adhere to best practice.

Quick searches

Conferences and seminars

Seminar

RICS Matrics South Wales: Candidate Support – Sessions

Thu 19 Sep 2024 - Thu 07 Nov 2024 • 13:00 - 14:00 BST • RICS Wales Office, 8a Creative Quarter, Morgans Arcade, Cardiff, CF10 1AF

Conference

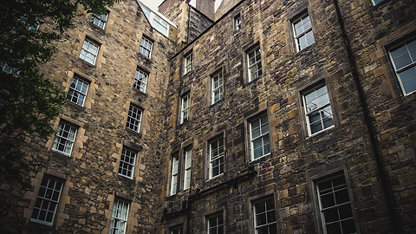

Global Building Conservation Conference 2024

• 7 Hours Formal CPD • Online

From £121

+ VAT

Seminar

RICS Matrics Manchester: Seminar - APC Support Session with Property Elite

Thu 26 Sep 2024 • 18:00 - 20:00 BST • Number 8 First St, Manchester, M15 4FN

Free

Conference

RICS/IPTI 11th Annual Caribbean Valuation and Construction Conference

Wed 02 Oct 2024 - Thu 03 Oct 2024 • 08:00 - 16:30 EST • Hilton Rose Hall Resort & Spa, Montego Bay

From $345

+ VAT

Conference

Conflict Avoidance Conference 2024

Wed 02 Oct 2024 • 12:00 - 16:00 BST • 4 Hours Formal CPD • Central London - address details will be shared after booking

£75

+ VAT

Conference

RICS in Hungary: The ESG impact on Real Estate

Thu 03 Oct 2024 • 08:30 - 11:00 CEST • 1.0 Hours Formal CPD • EY, 1132 Budapest, Váci út 20.

Conference

Scotland Rural Conference

Thu 03 Oct 2024 • 09:30 - 17:00 BST • 5.5 Hours Formal CPD • Leonardo Boutique Huntingtower Perth, Crieff Road, Huntingtower, Perth, PH1 3JT

From £195

+ VAT if applicable

Conference

Planning and Development Conference

Tue 08 Oct 2024 • 09:00 - 17:30 BST • 5 Hours Formal CPD • Cavendish Conference Centre, London, W1G 9DT

From £303

+ VAT

Conference

Hong Kong Conference

Tue 08 Oct 2024 • 09:00 - 17:00 CST • 6 Hours Formal CPD • Kerry Hotel, Hong Kong 38 Hung Luen road, Hung Hom Bay, Kowloon Hong Kong SAR

From $2530

QS & Construction Conference 2024

Thu 10 Oct 2024 • 09:00 - 17:00 GMT • 5.5 Hours Formal CPD • Royal Institution of Chartered Surveyors , 12 Great George Street, London, SW1P 3AD

From £303.60

+ VAT

Training Courses

Dispute Resolution

Diploma in Adjudication (South Africa)

• 255 hours formal CPD • Dispute Resolution • Online

From R43000

+ VAT

Training Course

Hong Kong F2F training: Preparing for the Case Study & Final Assessment

Mon 23 Sep 2024 - Tue 24 Sep 2024 • 18:30 - 21:30 HKT • 6 Hours Formal CPD • 29/F, Tower 5, The Gateway, 15 Canton Road, Harbour City, Tsim Sha Tsui, Kowloon, Hong Kong

From $1792

Training Course

Singapore F2F training "Commercial Property Valuation: DCF Techniques"

Wed 25 Sep 2024 • 09:00 - 17:00 SGT • 6.0 Hours Formal CPD • REDAS Boardroom, 190 Clemenceau Avenue, #07-01, Singapore Shopping Centre, Singapore 239924

From $650

Training Course

Australia F2F training "Valuation for non-Valuers"

Thu 10 Oct 2024 • 09:00 - 17:00 AEDT • 7 Hours Formal CPD • Cushman & Wakefield, Level 22, 1 O’Connell Street , Sydney NSW , Australia

From $595

+ VAT

Seminar

RICS NI Sustainability and SDGs – An introduction

Thu 17 Oct 2024 • 12:00 - 14:00 BST • 1.0 Hours Formal CPD • RICS NI Office, Harland & Wolff Room, Custom House, Belfast BT1 3ET

Free

Training Course

Australia F2F training - Contract administration of Construction Projects

Wed 23 Oct 2024 • 09:00 - 17:00 AEDT • 7.0 Hours Formal CPD • Altus Group, level 12/1 Market St, Sydney NSW 2000, Australia

From $500

+ VAT

Dispute resolution

Diploma in Adjudication in the Construction Industry

• 420 hours formal CPD • Online

£3919

+ VAT

Training Course

Singapore F2F training-“Asset Management: Strategizing An Efficient Asset Management Plan”

Wed 13 Nov 2024 • 09:00 - 17:00 SGT • 6 Hours Formal CPD • REDAS Boardroom 190 Clemenceau Avenue, #07-01, Singapore Shopping Centre, Singapore 239924

From $650

Training Course

New Zealand F2F Training-NZS 3910 Construction Contract Introductory Class

Mon 18 Nov 2024 • 09:00 - 17:00 BST • 7 Hours Formal CPD • KPMG, 18 Viaduct Harbour Ave, Auckland, 1010

From $668

+ VAT

Online training

Web Class

APC Supervisor and Counsellor Guide - two-part series

• 3.0 hours formal CPD • Online

From £98

+ VAT

Web Class

FIDIC Contract Principles and Practical Use - 3 Part Series

• 4.5 Hours Formal CPD • Online

From £181.50

+ VAT

Property management

Property Development Strategies - 3 Part Series

• 4.5 hours CPD • Online

From £181.50

+ VAT

Webinar

Middle East & Africa Project Delivery in MEA - Managing Third Parties in Contractual Relationships

• 1.0 Hours Formal CPD • Online

£33.75

+ VAT

Webinars

Webinar

Asset Management: Tools, Techniques and Practices - 3 Part Series

• 4.5 Hours Formal CPD • Online

From £181.50

Web Class

Global Introduction to Whole Life Carbon Assessment - 3 Part Series

• 4.5 Hours Formal CPD • Online

From £181.50

+ VAT

Webinar

Global modern methods of construction (MMC) and residential homes webinar

• 1.0 Hours Formal CPD • Online

From £25

+ VAT

Webinar

Global AI in Land and Resource Management Webinar

• 1.0 Hours Formal CPD • Online

From £25

+ VAT

Webinar

RICS Matrics Cornwall: Webinar - Candidate support with Property Elite: Ethics and Hot Topics

• Online

Free

Webinar

UK Home Survey Standard: Cracking in Residential Properties Webinar

• 1.0 Hours Formal CPD • Online

From £25

+ VAT

Webinar

Housing markets in 2024 and beyond: How can the sector leverage change?

• 1 Hour Formal CPD • Online

Free

Networking

RICS in Birmingham - Mocktail making afternoon

Tue 24 Sep 2024 • 12:45 - 14:30 BST • RICS, 55 Colmore Row, Birmingham, B3 2AA

From £10

+ VAT

Networking

Shaping the Future – Member Engagement Event Wales

Tue 24 Sep 2024 • 14:00 - 17:00 BST • 3 Hours Formal CPD • Sophia Gardens Cricket Ground Cardiff CF11 9XR

Networking

RICS Matrics Norfolk & Suffolk: Candidate Support - APC Meet the Assessor and Drop in Clinic

Tue 24 Sep 2024 • 18:00 - 19:30 BST • Arlingtons 13 Museum Street, Ipswich, IP1 1HE

Networking

RICS in West Midlands University Series - Introduction to Apprenticeships & Simulation Centre Tour

Wed 25 Sep 2024 • 15:00 - 17:30 BST • 1.5 Hours Formal CPD • The Simulation Centre (Coventry University), Cheetah Rd, Coventry CV1 2TL

Free

Networking

Lisvane and Llanishen Reservoirs - Tour, Talk and Paddleboarding

Wed 25 Sep 2024 • 16:30 - 19:00 BST • Lisvane and Llanishen Reservoirs, Lisvane Rd., Llanishen, Cardiff CF14 0BB

RICS in London: NELA CPD Event - MOBI Reforms (Multi Occupancy Buildings Insurance)

Wed 25 Sep 2024 • 19:00 - 21:00 BST • Royal Epping Forest Golf Club, Forest Approach, Chingford ,LONDON, E4 7AZ

£20

Networking

RICS in Exeter - Autumn legal update

Thu 26 Sep 2024 • 08:30 - 10:30 BST • 1.0 Hours Formal CPD • Ashfords LLP, Ashford House, Grenadier Road, Exeter, EX1 3LH

£10

+ VAT

Networking

RICS Wales Business Rates Update - Where are we now and where are we going?

Thu 26 Sep 2024 • 12:30 - 13:30 BST • 1.0 Hours Formal CPD • RICS Wales Office, Creative Quarter, 8a Morgan Arcade, Cardiff, CF10 1AF

Free

RICS Matrics x Brodies x CBRE Glasgow: ‘Spritz Social’

Thu 26 Sep 2024 • 17:30 - 20:00 BST • Brodies LLP, 110 Queen St, Glasgow G1 3BX

Matrics Event

RICS Matrics Essex: Candidate Support - APC Quiz

Thu 26 Sep 2024 • 18:00 - 20:00 BST • Strutt and Parker, Coval Hall, Rainsford Rd, Chelmsford CM1 2QF

£5

+ VAT

RICS Professional Support Packages

Exclusively designed for RICS Professionals & Candidates.

- Easily keep track of your learning progress

- Stay compliant and adhere to best practice

- Corporate Packages available

More from RICS

:16-9?$dpp-card-xxl$&qlt=85,1)